Banks dominate domestic debt market, report shows

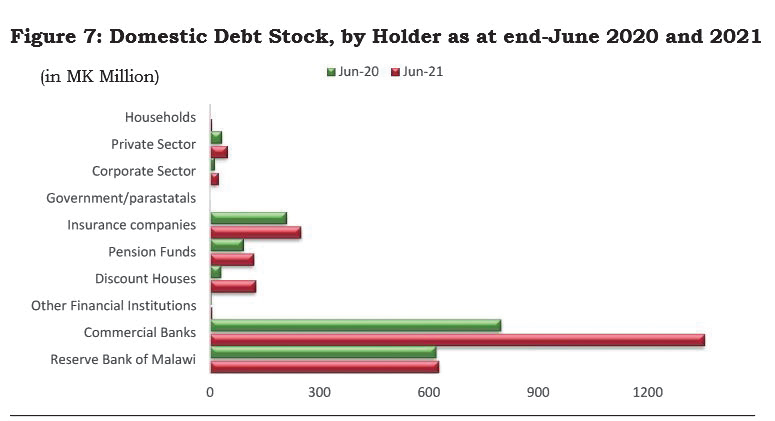

Local commercial banks continue to dominate on the domestic debt market as they are still ranked the biggest holders of domestic debt securities, according to a new report.

Malawi banks, already under heavy criticism for registering back-to-back supernormal profits, have discovered ‘gold’ in the domestic debt market.

This is because Treasury appears to be desperate for resources to finance statutory expenditures and other development needs, at a time when domestic revenue generation keeps faltering on account of Covid-19 pandemic.

The 2020/21 Public Debt Report show that by June 2021, banks were holding K1.4 trillion of the total domestic debt worth K2.6 trillion.

This means that more than half of total domestic debt is in the hands of banks, according to the report.

Reads the report in part: “In terms of domestic debt holders, commercial banks remained the biggest holders and increased their holdings of domestic debt securities from K798.98 billion in June 2020 to K1.4 trillion in June 2021.”

The Reserve Bank of Malawi (RBM) ranks second in terms of domestic debt by holder as it marginally increased its holdings from K621.30 billion to K628.64 billion during the same period, the report says.

On one hand, the insurance sector also increased its holdings from K210.38 billion to K250.57 billion while holdings by the households increased from K0.94 billion to K4.63 billion.

In terms of domestic debt by instrument, the report shows that of the K2.6 trillion domestic debt stock, 82 percent (K2.1 trillion) were Treasury notes, 13 percent (K346.20 billion) were Treasury bills and five percent (K119.76 billion) were promissory notes.

Catholic University of Malawi economics lecturer Hopkins Kawaye said in an interview that the current debt trajectory for Malawi is not sustainable, warning that it will lead to “debt overhang”.

Debt overhang is simply a debt burden situation that is so large that the country cannot take on additional debt to finance future projects.

Kawaye said at K2.6 trillion, domestic debt stock alone has crossed the line of the International Monetary Fund (IMF) recommendation of 20 percent domestic public debt as percentage of gross domestic product.

He said: “If we keep on borrowing, then taxes will keep on rising to collect revenue to payback these loans.

“This causes inflation and the purchasing power of consumers is lessened.”

In a statement on Wednesday, IMF stressed the need for determined implementation of policy adjustments to address Malawi’s macroeconomic imbalances, restore debt sustainability, rebuild external buffers and reduce poverty and inequality to improve social outcomes.

By June 2021, Malawi government had borrowed K1.4 trillion over a one-year period between June 2020 and June 2021, pushing Malawi total public debt stock to K5.5 trillion.