Is public debt an issue?

We all have run into debt at some stage in our lives for different reasons. Financial planners usually tell us to often check our spending against our earnings to minimise the level of debt.

If debt is not properly managed the trend is refinancing. You borrow to pay another debt.

Examples abound in real life and fiction abound—from the mysterious Gamphani of Bolero to some clever Unoka, a fictitious character in Chinua Achebe’s part. Governments borrow and run huge debts. Some make money out of this debt, others pay for it. Should the Malawian taxpayer or indeed anyone that has the interest of it show some concern?

For many years and, in different forums, banks have been branded bad boys of the credit system. I do not like them too and, most of you don’t. They surely know it and they do not really care, but like all shrewd businesses play their bets well. Even loan sharks play the rational lender and target those that have the ability to pay or can be easily harassed to forfeit their assets.

Loan sharks and banks belong to the same father but different concubines that fight for attention. You, the borrower, are the one they fight for and I mean the less risky.

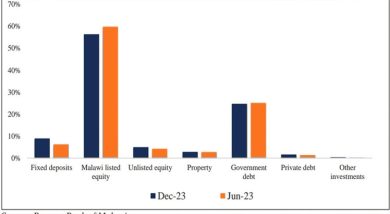

A closer examination of the assets of our commercial banks gives you more reasons to be worried about public debt. The private sector has a huge competitor for capital finance.

For most number of years, the banks have bought a lot of government debt. To simplify matters, the traditional assets of commercial banking, especially loans to the private sector have declined in preference for government treasury bills.

There is no fault in public debt but concern should be made in the context of any policy that can affect the competitiveness of our country. Precisely, selling of the compendium projects and its consequent success cannot be divorced from the consequences of debt.

Public debt and its easy part. It is a free rider. Not many of us ever feel the pinch of paying bank the loans directly. But spare sometime and examine the success each one of us has in trying to get a bank loan.

Banks continue to sell properties and other assets following default. That is how public debt bites at individual levels as it is a catalyst for high interest rates. If government is in dire need for cash and given its almost zero default rate, banks would not care much if you cannot access loans from them.

If you do, then you have to dig deeper but at the same time be a ruthless entrepreneur to survive. That is just part of the cost before you deal with power and water outages and the huge transport costs. Most of these costs maybe pointing to the same source.

Lenders of money and we simply keep passing these costs from one another. So do not be surprised if one industry mints billions while the rest barely survive and if anything need government contracts paid out of public debt. Some cyclical puzzle.

The reality is the asset holding of commercial banks has been steadily rising and getting skewed towards government securities. If commercial banks are denying loans to the private sector while public debt skyrockets, it should get each of us worried.

While interest rates are dependent on many factors, public borrowing from the banking system is a key determinant. It simply flashes money in the system but this money is not available to private entrepreneurs that create jobs and pay taxes because of its high cost.

The way it is, government is the private sector biggest competitor, at least for financial resources. There is a crowding out effect, a term macroeconomists use to describe the inability of private sector to borrow from banks. The high cost of borrowing should therefore be linked to the success of how we sell the compendium. It is all an ingredient of the cost business.

Otherwise I would suggest that those empowered to borrow funds to be repaid by the taxpayer, pay attention as to why it is done and its consequences. I would suggest, at some stage, they put themselves in the role of a bread winner that wants to borrow for a beer or for educating their children or refinancing their business loan.

After all, public borrowing is a collection of individual households in principle. This means we borrow to create jobs that bring food on the table and enable us have a decent living. If it does not, one spouse usually consults the counsellors for an indaba to change things in the home.

Be concerned with public debt if basic socio-economic indicators require a divine prayer after decades of debt accumulation.

Economics of sovereign debt with a cheek of cynicism.I really like your observations but Malawians are not the ones to pay attention to thes arcane explanations.In fact I am wiling to bet that even for the most educated Malawians,none is ready to listen to these words of wisdom.Personally I hate sovereign debt because I know that sooner or later(maturity at par of treasury bills for example),we will pay dearly!!! If its not through our taxes then it will be through high interests rates at to the banks who seem to be benefiting either way( by lending to the government or by loaning money to the clueless Malawians!!).

But lets keep up this good writing.Its a step forward.

On another note,the honorable minister of finance two weeks ago talked about currency stabilization.He claimed that this was due,among other factors, to currency swap!!!Perhaps this was a good strategy to stabilise the ailing kwacha,but for him to claim that noone will suffer was being extremely naive.Currency swaps are at their core based on swapping of debt obligations.Debt as going by the articles explanation will be repaid either way.The question is who pays?Taxpayers of course!!I don’t buy the idea that swaps are a form of securitizing ourselves from eventual currency fluctuations!!! There are no efficient markets anymore!!!!!

True ngwanji but my understanding is that this article is not talking about sovereign debt strictly so called since the issues raised relate to domestic debt and his appetite by the state for debt financing can lead to high interest rates. I agree with you however that the information we were told of currency was not correct. The deal with the PTA bank involves the sake of sovereign debt and not currency swaps. Otherwise the fundamental question is which currency did we give to swap? I also find this obsession with 0% interest sovereign loans interesting. Suppose you borrow $1B today at 0% which you must pay after 10 years. The fundamental issue after 10 years will no longer be the 0%?interest but how many Kwachas have to be raised to pay this loan. With the rate of depreciation of the Kwacha we may find that the actually interest (price of borrowing) maybe over 1,000% based on currency depreciation over the same time. For some strange reason, this is never an issue when we are borrowing. We must be worried.

Well written; and also pitched at the right level for easier absorption. I agree with your views 100%!