Kwacha fall hits telecoms firms

The continued depreciation of the kwacha has not spared players in the telecommunications industry as their annual profits have been affected by foreign exchange losses, figures show.

An analysis of the 2021 published financial statements for Malawi Stock Exchange-listed Airtel Malawi plc and TNM plc shows that the two firms registered an increase in forex losses during the year under review.

Airtel Malawi plc financial results for the year ended December 31 2021 show that during the year under review, the company lost K5.6 billion on the back of the kwacha depreciation against the dollar.

During the previous year, the impact of forex loss was at K3.6 billion.

TNM plc, on the other hand, recorded a 16 percent increase in depreciation expenses to K16.3 billion from the previous year’s K14.05 billion.

In a published financial statement yesterday co-signed by Airtel Malawi plc board chairperson Alex Chitsime and managing director Charles Kamoto, the firm said the country’s economy and company are exposed to the continued impact of Covid-19, kwacha depreciation and scarcity of foreign currency.

Reads the statement in part: “We continue to focus on investing more and growing customers and revenue followed by containing cost and diversifying currency sourcing to mitigate the exposures.”

TNM plc, in its financial statement for the year ended December 31 2021 co-signed by board chairperson George Partridge and audit committee chairperson Lekani Katandula, said the volatile exchange rates and forex scarcity will continue to increase the cost of toperations.

“The macro-economic environment is expected to remain challenging, putting pressure on revenue and margins,” reads the statement.

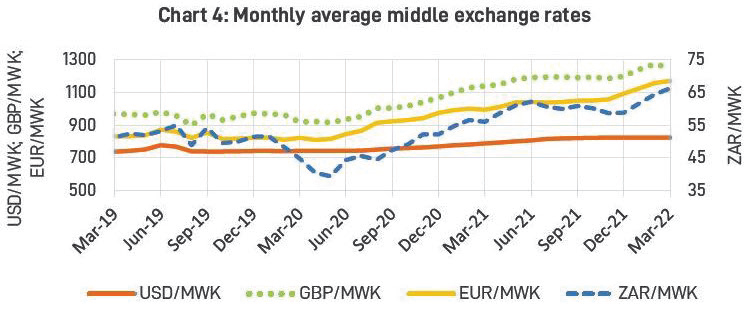

The kwacha has consistently depreciated against major trading currencies since the second half of 2020 on account of the persistent shortage of forex although the Reserve Bank of Malawi (RBM) official dollar and Malawi kwacha middle exchange rate showed some stability around K823 in the first quarter of 2022.

An industry expert, who spoke on condition of anonymity, said the depreciation expenses are due to rising capital expenditure in network transmission, systems catering for capacity expansion, improvement and future use as customer base and data usage grow.

In its February 2022/23 National Budget response, Malawi Confederation of Chambers of Commerce and Industry observed that Covid-19 continues to reverse macroeconomic fundamentals, most notably the weak foreign reserves position.

Airtel Malawi plc after-tax profit went up to K32.3 billion while that of TNM plc was recorded at K9.69 billion.

One Comment