Mkwezalamba speaks on economy turn around

Malawi’s Finance Minister Maxwell Mkwezalamba has said the economy is now healing from severe impact of cashgate after months of being bruised by high interest rates, a massive depreciation of the local currency and heavy domestic borrowing, among others.

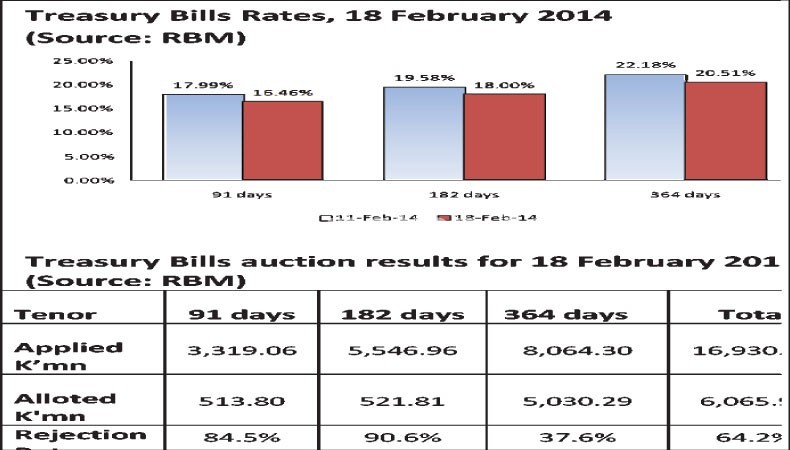

Mkwezalamba has also attributed the sudden turn around of the economy characterised by falling interest rates, a stable currency and falling Treasury Bill (T-bills) rates to prudent fiscal and monetary policy implementation by Treasury and the Reserve Bank of Malawi (RBM).

“We saw what happened to the movement of the exchange rate following the suspension of budget support by donors. But also due to the cashgate, there was high domestic borrowing that took place in the first quarter of the 2013/14 budget, interest rates also increased but more importantly we saw a revised budget framework,” Mkwezalamba recalled.

Mkwezalamba was responding to Business News query at the released forensic audit news conference in Lilongwe on Monday demanding him to assess the magnitude of cashgate damage to the economy to date.

Malawi’s major donors sitting under the Common Approach to Budgetary Support (Cabs) continue to withhold budget support worth $150 million over cashgate, and since the decision was made in November last year, such withheld money has left a huge fiscal gap which has prompted government to resort to heavy borrowing to patch up revenue shortfall in the implementation of the budget.

Mid-January this year, Treasury admitted that it over-borrowed domestically in the first quarter of the 2013/14 national budget by K58.7 billion.

“Now there is a turnaround as exchange is stabilising after it had depreciated quite significantly within a short period of time, but we have seen stability in the past two weeks. This is all because of government’s commitment to prudent and tight monetary policy implementation by government,” said the finance Minister.

The minister also said it is pleasing that interest rates have started falling on the market and the T-bills rates have dropped to around 20 percent from around 40 percent.

He said by cutting interest rates, commercial banks are merely responding to improved economic environment in the country.

A week ago, two biggest banks, namely National Bank of Malawi and Standard Bank, started to announce the revision of base lending rates to 36 and 35 percent respectively from around 40 percent.

And following such a decision, most commercial banks have followed suit by slashing down both their deposits and mortgage rates.

He added: “Yes indeed cashgate had negatively impacted on the economy but because of sound fiscal and monetary policies, we have seen and we only expect things to get better as we address the public finance management system.”

In November last year, Reserve Bank of Malawi (RBM) Governor Charles Chuka described cash-gate as ‘too serious,’ warning that the cost of the scandal could be too heavy on Malawi.

The RBM boss also admitted that in the wake of the recent revelation of massive public funds abuse at Capital Hill, the country is being viewed as ‘a country without systems’ on the global scene.