Where are carbon tax funds?

The parliamentary cluster committee on Agriculture and Natural Resources has pressed Treasury officials to explain how it spent carbon tax levy which it began collecting last year.

On Tuesday, the committee probed the Ministry of Finance officials on how the K1.2 billion it collected in the 2019/20 financial year through both the Directorate of Roads Traffic and Safety Services (DRTSS) and the fuel levy was spent.

By November 25 2019, a few months after the introduction of carbon tax, over 170 motor vehicle owners had paid and obtained carbon tax discs. The operation started at DRTSS offices before the revenue was made part of the fuel levy under the Malawi Energy Regulatory Authority (Mera).

In his presentation, budget director Peterson Pondera said the carbon tax initiative was introduced to boost revenue collection and that all funds generated were deposited into government’s account number one.

He explained that some of the carbon tax resources were released into the coffers of the Ministry of Natural Resources while other funds were used for purposes which he did not disclose.

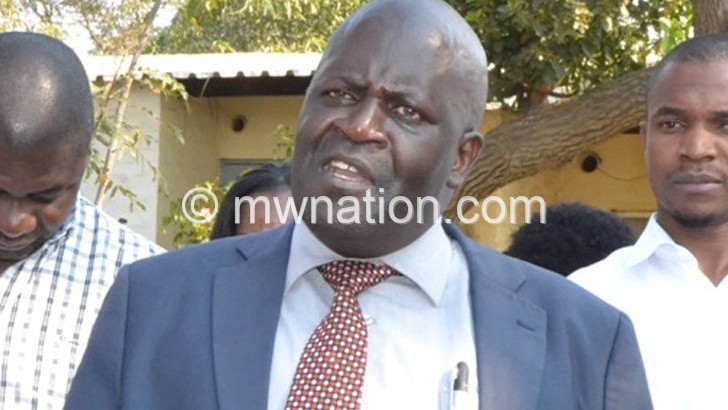

In response, Natural Resources Committee chairperson Werani Chilenga condemned the process, saying Treasury deceived Malawians that the initiative was introduced to collect revenue for climate change interventions and yet its main objective was to boost the revenue collection under a wider tax base.

He demanded that Treasury should apologise for deceiving Malawians as no single tambala has been allocated for mitigating climate change effects.

Chilenga said: “Telling this cluster committee that the money you have collected has not been used and that it was introduced to increase the tax base is a confusing issue. Tell us why (you are) cheating Malawians that it was a carbon tax. I have to be honest, that the Ministry of Finance is not helping this nation.”

But in his 2019/20 budget presentation in Parliament, former minister of Finance Joseph Mwanamvekha stated that the carbon tax initiative was introduced to boost the revenue base.

Said the former minister: “Carbon tax was introduced in the 2019/20 Budget and applies on motor vehicles based on engine capacity. In line with the ‘‘Polluter Pays Principle,’’ and to improve its efficiency and expand the base, carbon tax will now be charged on petrol and diesel at K5.00 per litre.

“However, foreign registered motor vehicles under Temporary Import Permit or Transit will still be required to pay carbon tax at the point of entry based on engine capacity. Government has consulted Mera and has been assured that this measure will not lead to an increase in fuel prices and government will be closely monitoring the situation.”

At one point, Pondera explained that the carbon tax funds were deposited into the government account number one because the Ministry of Forestry and Natural Resources had not yet developed guidelines on the use of the resources.

He said: “We did not give the money to the ministry because there are no guidelines yet. The ministry was supposed to develop guidelines on the operationalisation of the fund. And we cannot reinvest resources now because they were already used for other purposes. But we will do that with what we will collect this year…”

The budget director pointed out that the Ministry of Finance has projected to collect K3 billion during the 2020/21 financial year.

In his presentation, Ministry of Forestry and Natural Resources director of planning Hetherwick Njati said will require an estimated budget of K98.5 billion. But he expressed concern that the Other Recurrent Transactions budget has dwindled by 12 percent.

He added that the ministry needed enough funds to operationalise the Atomic Energy Regulations Authority and pay balances which it has with international organisations.

Treasury is expected to appear before the committee again today or tomorrow, to give an account on how it spent the K1.2 billion collected during the previous financial year.

The Malawi Revenue Authority (MRA) announced on January 28 2020 that in two months it had collected K452 million in carbon tax from motorists.

According to the texts instituting the carbon tax in Malawi, the revenues collected must be transferred to the Environment Fund. A structure managed by the Ministry of Natural Resources, Energy and Mines in collaboration with the Malawian Environmental Protection Agency. The agency will use the revenue to finance projects to combat environmental degradation and fight for environmental protection.

Introduced in Malawi’s 2019/20 budget, this carbon tax is levied annually and varies from K4 000 to K15 500, depending on the size of the car’s engine.