World Bank says Covid-19 threatens remittance flow

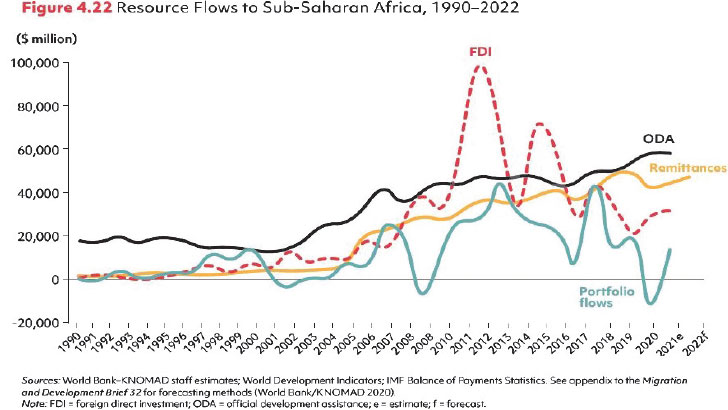

The World Bank says Covid-19 remains a huge risk to cross-border trade and flow of remittances to Malawi and other sub-Saharan African countries, a move that threatens households’ welfare.

In its November 2021 Migration and Remittances Brief, the Bretton Woods institution says the situation remains critical in the absence of sufficient quantities of vaccines, human capital and logistics capacity.

Reads the report in part: “Despite easing economic growth in host regions of the world and continued uncertainty regarding the course of the pandemic, remittance receipts in sub-Saharan Africa are projected to accelerate in 2022.

“Risks in 2022 look relatively high although several developments may offer potential to support flows. The uncertain path of the pandemic, slowing host-country growth, and intra-regional conflict amplify the risk profile.”

Ironically, the sub-Saharan Africa remains the expensive region to send remittances to. World Bank figures show that it costs an average of eight percent or about $17 (about K14 000) of the value of the transaction during the first quarter of 2021.

At eight percent of the value of the transaction, the cost is still far from achieving the three percent target set out in Sustainable Development Goal number 10.

In 2020, 80 percent of households in Malawi experienced a decline in remittances as money sent to the region declined by an estimated 12.5 percent to $42 billion (about K34 trillion).

In an interview on Sunday, Malawi University of Business and Applied Sciences associate professor of economics Betchani Tchereni said remittances play a crucial role to the economy.

He said a decline in remittances affects households and the economy at large.

Tchereni said: “A decline in remittances is a missed opportunity for the country’s economy.

“Many children are able to attend school and have their welfare taken care of because of remittances. Other beneficiaries are able to uplift the status of their households by building decent houses in the rural areas.”

In a statement accompanying the report, World Bank lead economist for migration, remittances, social protection and jobs global practice, Dilip Ratha, decried the high cost of sending money across international borders.

He said: “Corridor-specific data reveal that remittance costs tend to be higher when remittances are sent through banks than through digital channels or money transmitters offering cash-to-cash services.”

“Policymakers should continue their efforts to keep remittances flowing by lowering the cost of remittances, increasing access to banking for migrants and remittance service providers and making policy responses to the Covid-19 crisis [in terms of access to vaccines, healthcare, housing and education] inclusive of migrants.”

Reserve Bank of Malawi (RBM) figures show that in 2020, Malawi received $2143.1 million (about K166.6 billion) in personal remittances, a drop from $265.7 million (about K158.9 billion) recorded in 2019.

RBM attributed the drop to the economic crisis brought about by the Covid-19 pandemic which triggered a fall in the wages and employment of migrant workers.