Covid-19 boosts digital payments

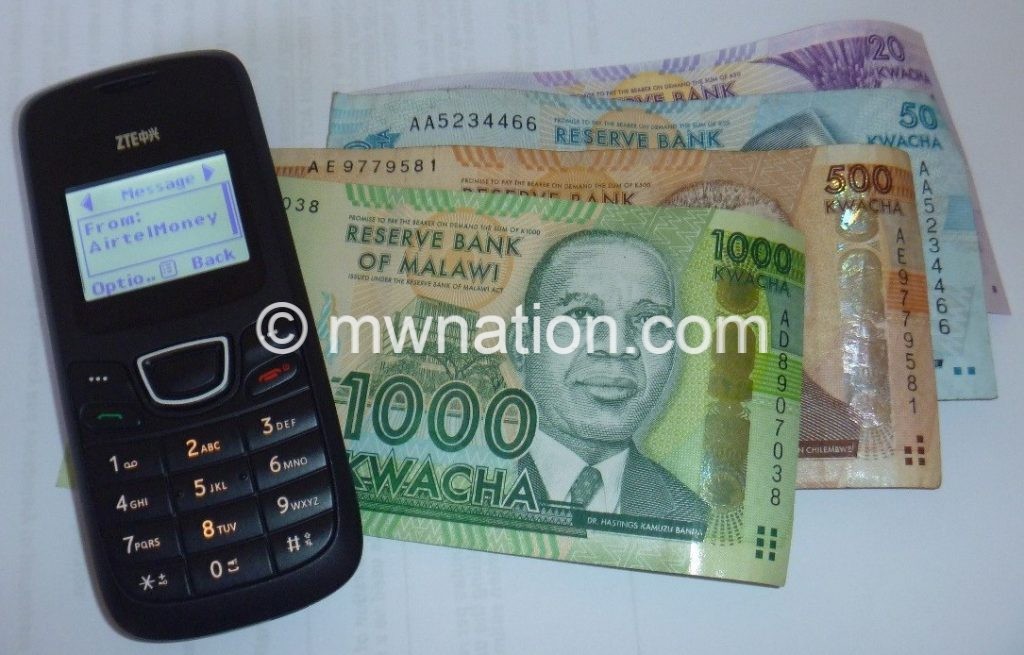

Malawi registered a boom in cashless or electronic transactions in 2020, largely due to the Covid-19 pandemic that saw people prefer digital payments to hard cash.

The year saw commercial banks and mobile money service providers such as Airtel Money and TNM Mpamba scraping off user fees to allow customers to use digital means of paying for services as part of preventing the spread of coronavirus.

In April, weeks after the country registered its first cases of Covid-19, the Reserve Bank of Malawi (RBM) agreed with mobile phone companies to scrap off user fees to motivate customers increase use of mobile money and other

digital platforms when paying for goods and services.

The moratorium was extended up to the end of December this year.

The decision saw mobile network operators—Airtel Malawi plc and TNM plc—completely removing user fees and charges on personal transfers on the same network for three months.

RBM then said by removing the fees and charges coupled with the subsequent reduction in user fees and charges, the two companies will then forgo an estimated K600 million for three months, representing K200 million each month.

Airtel Malawi plc managing director Charles Kamoto said his telecoms firm is a key partner to government; hence, its decision to support the nation during Covid-19 pandemic.

“We believe this will be a relief to most Malawians. We have to also state that we are working on a number of issues related to the same,” he said.

On his part, former TNM plc chief executive officer Michiel Buitelaar said much as some customers felt the company could have done more in response to Covid-19 fight, it was important to understand that the company needs also to conform to key performance indicators (KPIs) set by Malawi Communications Regulatory Authority (Macra), which requires that it remains in robust financial health.

Earlier, RBM also signed an agreement with commercial banks to provide relief to borrowers whose loan repayment would be affected by the loss of business due to the impact of Covid-19.

RBM National Payment System Report for the Third Quarter (July to September) of 2020 shows that 132.2 million transactions were processed in all payment streams, representing an increase of 30 percent from the second quarter (April to June) of 2020.

In the period under review, the corresponding total value of transactions also increased by 20.7 percent to K16.1 trillion.

RBM said the trend largely reflected increased economic activities during the period.

During the same period, there was a significant improvement in the overall performance of retail digital financial services (DFS) transactions compared to the preceding quarter.

The volume and value of DFS transactions rose by 30 percent and 30.7 percent to K130.4 million and K2 trillion, respectively, during the period under review.

RBM said the outturn shows increased usage of DFS channels during the period under review, owing to their convenience and safety as opposed to cash and other paper-based payment instruments.

Relative to the corresponding period in 2019, DFS performance shows improvement as the volume and value of transactions processed during the period rose by 63.7 percent and 46.1 percent, respectively.

The outturn buttresses the fact that there is a growing appetite for DFS when making payments owing to their convenience and speed at which transactions are settled.

“Stakeholders are, therefore, encouraged to continue with their efforts of improving the digital payments landscape to drive increased adoption and usage of electronic payments in the country,” reads in part the RBM report.

On his part, Consumers Association of Malawi executive director John Kapito said while the increased uptake of digital payment systems was good news, challenged service providers to work on their network systems which have largely let down consumers by leaving transactions hanging or fail altogether.

He said some consumers opt for cash transactions not out of will but because they shun the digital payment systems’ failure which has left them embarrassed and inconvenienced.