Government confirms debt unsustainability

Ministry of Finance and Economic Affairs says Malawi’s debt is unsustainable over the medium-term with the county’s risk of debt distress rating moving from moderate to high.

This means that the country is unable to fulfill its financial obligations and debt restructuring— a change in borrowing terms to make it easier to pay back.

The situation follows rising debt which is due to structural imbalance between revenues and expenditure

A 2022/23 draft financial statement published by the Ministry of Finance and Economic Affairs which Business News, has seen indicates that the change in the rating is due to the worsening present values of total debt as a percentage of the gross domestic product (GDP) (53.3 percent), external debt as a percentage of GDP (22.4 percent) and external debt as a percentage of GDP (235.7 percent) as well as debt service as a percentage of exports ( 44.1 percent) and as a percentage of revenue (31.8 percent) projected for 2022.

This is against a threshold of 35 percent, 30 percent, 140 percent, 10 percent and 14 percent, respectively.

Reads the statement in part: “Debt burden indicators have worsened due to lowering of thresholds due to the downgrading of Malawi’s debt carrying capacity from medium to weak; reclassifying of some debts held by nonresidents from domestic to external debt; and conversion of the Reserve Bank of Malawi’s short-term reserve liabilities to medium-term external debt.”

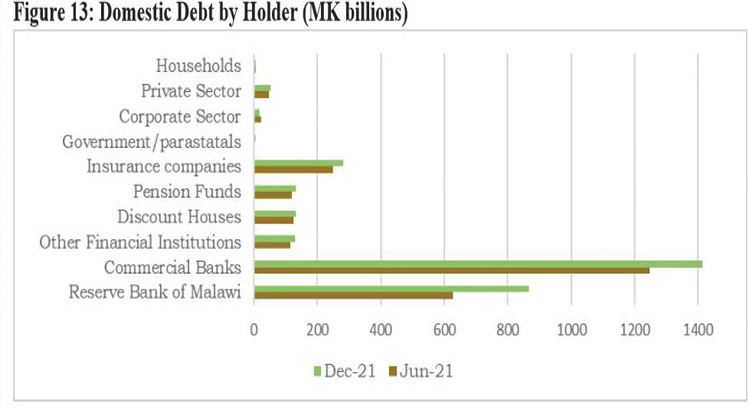

Treasury figures show that as at December 31 2021, total public debt stock stood at K5.8 trillion, or 56.8 percent of rebased GDP, as compared to a stock of K5.45 trillion, or 58.8 percent of GDP in June 2021.

This equates to an increase of 7.1 percent in absolute terms, but a decrease of two percentage points as a ratio of GDP.

The end December 2021 total public debt stock comprised K2.8 trillion (27.3 percent of GDP) external debt and K3.04 trillion (29.5 percent of GDP) domestic debt.

In his 2022/23 Budget Statement, Finance and Economic Affairs Minister Sosten Gwengwe said debt management will be at the centre of the 2022/23 Budget implementation, adding that his ministry is currently reviewing its domestic debt profiles with a view of restructuring debt towards longer maturity period, which will address the current debt sustainability concerns.

In an interview yesterday, University of Malawi economics professor Ben Kaluwa said there is need for fiscal authorities to look at and address the pressure points of ballooning debt, especially in the recurrent budget where civil servants’ salaries take up a huge chunk of the budget.

He said: “It is like we have been taken by surprise all the time. There is nothing strategic about how we manage debt.”

In the 2022/23 financial year, revenue and grants are projected at K1.96 trillion while expenditure is pegged at K2.84 trillion with a projected fiscal deficit of K884 billion

One Comment