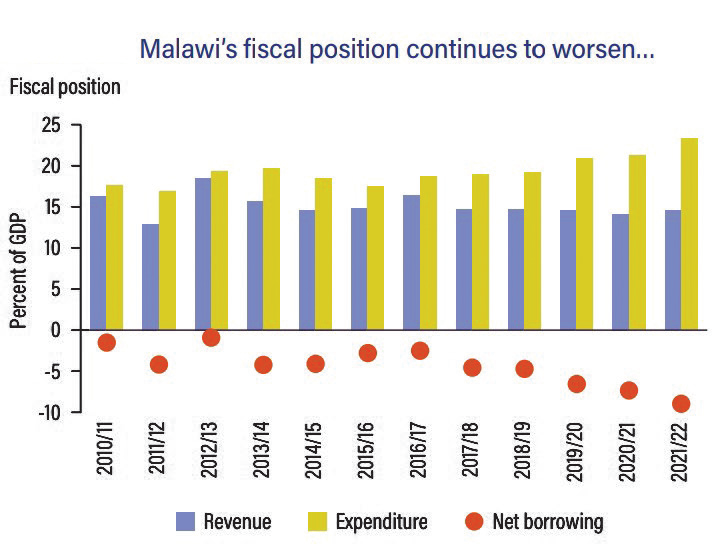

Widening fiscal deficit worries World Bank

The World Bank has bemoaned Malawi’s widening fiscal deficit describing this as a key driver to Malawi debt, which is becoming unstatainable.

The fiscal deficit, the bank says, is consequently driving domestic debt service upward, increasing the fiscal burden from payments on both interest and principal.

The World Bank’s sentiments on the growing fiscal deficit is contained in the institution’s 14th edition of the biannual Malawi Economic Monitor (MEM) titled ‘Strengthening fiscal resilience and service delivery’, which was published recently.

Reads the report in part: “Financing of government fiscal deficits using high-cost domestic borrowing continues to drive domestic debt on an upward trajectory.”

The World Bank fears that continued borrowing will further reduce fiscal space for development spending and risks crowding out private sector investment.

In the 2022/23 National Budget, overall fiscal balance is estimated at a deficit of K884 billion, which is 7.7 percent of GDP to be financed through foreign borrowing amounting to K230.07 billion and domestic borrowing amounting to K653.98 billion.

The World Bank, however, expects that the fiscal space is expected to remain constrained, despite an increase in revenue and reduced spending.

Minister of Finance, Economic Affairs Sosten Gwengwe while admitting that fiscal deficit is now a cause for concern, and is beyond the internationally acceptable level of three percent of GDP, indicated that the government will ensure implementation of fiscal consolidation measures to enhance revenue collection and manage expenditures.

“To enhance revenue collection, the ministry will continue rolling out the implementation of the just launched domestic revenue mobilisation strategy (DRMS), which was developed under the theme ‘Building a Tax Compliant Culture for national development’.

“This budget will embark on a painful but necessary journey to start flattening the net lending line and in the short to medium term put it on a sustainable downward trajectory,” he said in the 2022/23 budget statement.

In Malawi, experience has shown that fiscal deficits have been financed mainly by costly domestic borrowing.

The rising domestic financing since 2018 as well as borrowing from regional development banks on non-concessional basis has since significantly increased Malawi’s public debt, which stood at 59 percent of GDP as at June 2021.

For instance, in view of the revenue under collections, the previous financial year was revised upwards from K2.190 trillion to K2.334 trillion with total revenues and grants revised upwards from K1.435 trillion to K1.523 trillion, representing 16.5 percent of the country’s GDP.

Meanwhile, total revenues and grants for the 2022/2023 fiscal year are estimated at K1.956 trillion representing 17.2 percent of GDP, while total expenditure is projected at K2.84 trillion, representing 24.9 percent of GDP.

Of the total expenditure, recurrent expenses are estimated at K2.019 trillion, and development expenditure is programmed at K820.67 billion.